cost of dog health insurance explained with calm, practical guidance

What actually drives the price

Costs aren't random. They reflect risk and how you share it with the insurer. Knowing the levers helps you pay only for what you truly need.

- Breed and size: Large and predisposed breeds usually cost more due to orthopedic or genetic risks.

- Age: Premiums rise with age; enrolling early often locks in better terms.

- Location: Veterinary care varies by region; urban clinics can be pricier.

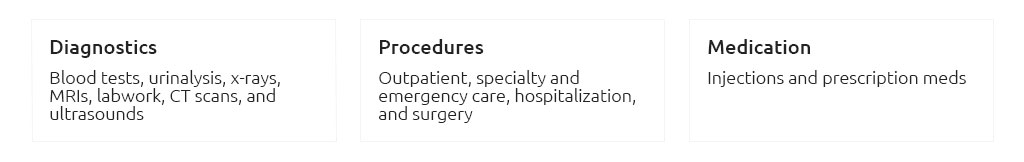

- Plan type: Accident-only is cheaper; Accident + Illness costs more but covers big vet bills.

- Deductible, reimbursement, annual limit: Higher deductible and lower reimbursement reduce premiums; higher annual limits raise them.

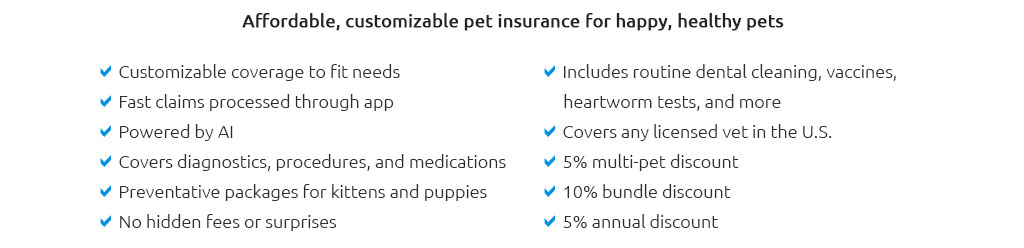

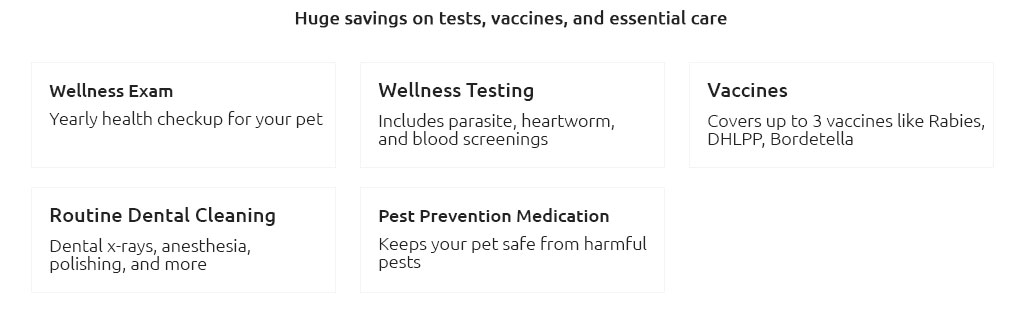

- Add-ons: Wellness, dental illness, rehab, or exam-fee coverage can add 5 - 25%+.

- Claims history and inflation: Renewal rates may adjust annually as medical costs evolve.

Typical price ranges (so you can set expectations)

For dogs in many U.S. areas, Accident + Illness plans often land around $30 - $90 per month, with smaller mixed breeds on the low end and large or high-risk breeds on the high end. Accident-only can be roughly $15 - $35. Wellness add-ons, if chosen, typically add another $10 - $30. Exact quotes vary by age, region, and plan design.

How plan design changes the bill

Think of premiums as a slider: the more risk you carry, the less you pay each month. Choose a number you're comfortable paying out-of-pocket today for a sudden injury, then let the plan handle the catastrophic costs.

- Deductible: $500 vs. $250 can lower premiums meaningfully; pick the highest you can comfortably pay once per year or per condition (policy dependent).

- Reimbursement: 70% costs less than 90%; the difference is noticeable on big claims.

- Annual limit: $10k - $20k covers most major events; "unlimited" costs more but reduces ceiling worries.

A brief real-world moment

On a Saturday trail run, a friend's Labrador tore a cruciate ligament. The surgery quote: several thousand dollars. Their mid-tier plan with a $500 deductible and 80% reimbursement kept the out-of-pocket manageable. Premiums felt justified - no scrambling, no delay.

Hidden costs and fine print to watch

- Waiting periods: Knees/hips sometimes have longer waits; early enrollment helps.

- Bilateral exclusions: One injured knee now may exclude the other later if not clearly covered.

- Exam fees: Not all plans cover them; that can add up.

- Prescription foods/supplements: Often excluded unless medically necessary and stated.

- Pre-existing conditions: Not covered; switching insurers can reset this history.

Skeptical aside: if a plan looks unusually cheap, I quietly ask what's missing - caps, exclusions, or steep coinsurance on big claims.

Build a confident, risk-aware budget

- Gather at least three quotes for your dog's age, breed, and ZIP code.

- Pick a deductible you can pay today without stress; that's your personal safety line.

- Choose a reimbursement level that keeps worst-case bills survivable.

- Set an annual limit aligned to real costs: cruciate surgery can reach $4,000 - $7,000+, cancer care can stretch beyond $10,000 in some areas.

- Review sample policies for exclusions, exam fee coverage, and orthopedic clauses.

Quick benchmarks (not promises, just orientation)

- Puppy, small/mixed breed in a mid-cost city: roughly $30 - $60 for Accident + Illness.

- Adult large breed: roughly $50 - $90.

- Senior dog: roughly $80 - $140, reflecting higher risk.

- Accident-only: roughly $15 - $35.

Ways to keep lifetime costs sensible - without risky gaps

- Enroll early: helps avoid pre-existing labels and extended orthopedic waits.

- Prioritize coverage over bells and whistles: core Accident + Illness often matters most.

- Consider higher deductibles thoughtfully: lower premiums, but make sure you can pay it.

- Evaluate wellness add-ons: convenient, but they don't always save money versus paying routine care directly.

- Ask about discounts: annual pay, multi-pet, or employer benefits may apply.

- Think before switching: you might lose coverage for anything previously noted; continuity can be valuable.

Bottom line

Clarity beats surprises. Choose a plan that reliably catches the expensive, unexpected events, fits your budget today, and stays transparent about limits and exclusions. That's how the cost of dog health insurance becomes a steady, predictable safeguard - not a leap of faith.